JioHotstar means for the streaming biz: A year after Reliance Industries and Disney agreed to merge their media businesses in India, their newly formed joint venture, JioStar, has officially launched JioHotstar. Announced on February 14, this platform integrates JioCinema and Disney+ Hotstar, offering an extensive library of nearly 300,000 hours of entertainment in 10 languages. With a staggering 500 million users, JioHotstar is poised to set a new benchmark in the global streaming industry.

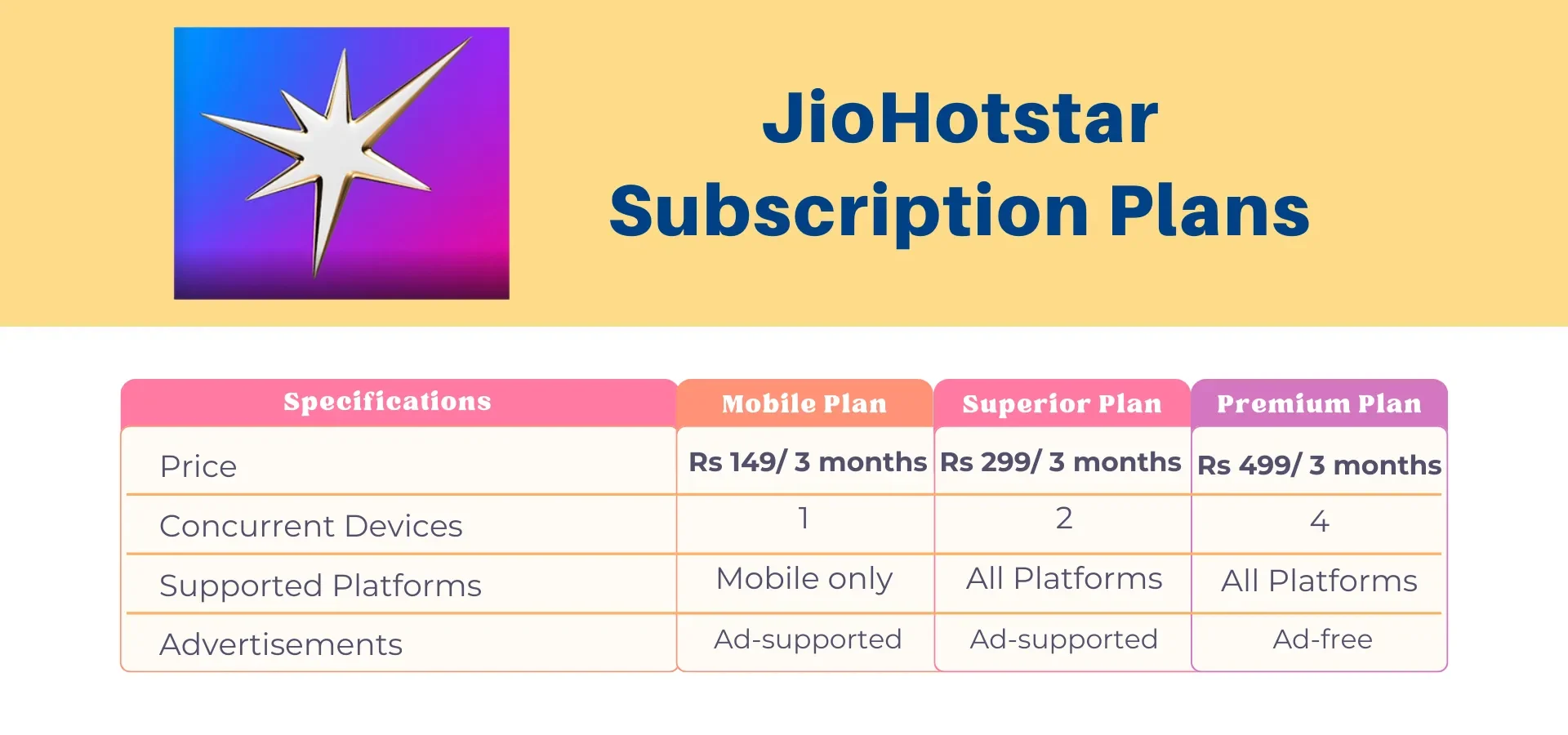

JioHotstar brings together content from major studios such as Disney, NBCUniversal’s Peacock, Warner Bros. Discovery’s HBO, and Paramount. Subscription plans start at Rs 149 for three months, promising an entertainment package that aims to offer “something almost no other streaming service globally provides.”

However, unlike JioCinema, which previously provided a significant portion of its content for free, JioHotstar requires a subscription. Users can access content for a limited period before needing a paid plan. Additionally, the Indian Premier League (IPL), which has been streaming for free since JioCinema acquired the rights in 2023, will now be behind a paywall.

Despite this shift, sources indicate that Jio Mobile and Jio WiFi customers—encompassing approximately 475 million mobile users and 14 million connected TV users—will continue to enjoy free access to IPL matches.

Will JioHotstar Reshape India’s OTT Landscape?

Ashish Bhasin, founder of The Bhasin Consulting Group, highlights the challenge Indian OTT platforms face in balancing affordability and revenue generation. He emphasizes that while a niche audience is willing to pay premium prices, the majority of Indian consumers remain price-sensitive.

“For OTT services to become truly mainstream, cost-effective, bundled subscription models will be key. High pricing will deter many potential subscribers,” Bhasin explains.

The biggest hurdle for JioHotstar, he believes, is transitioning from a free model to a paid one. Paywalls tend to reduce user numbers, and while events like the IPL can drive temporary spikes in subscriptions, many users may cancel once the event concludes. The long-term sustainability of the platform will depend on when and how subscriber numbers stabilize.

“Fewer subscribers also mean lower ad revenues. Advertisers, particularly FMCG brands that rely on mass reach, might hesitate until the platform’s numbers grow again,” he adds.

The key to sustained growth, Bhasin notes, is a steady stream of high-quality content. While acquiring rights to top-tier content is achievable in the short term, maintaining consistency over time is the real challenge. He stresses that consumers prioritize content quality over platform loyalty, making it crucial for JioHotstar to deliver compelling programming at competitive pricing.

Competitive Edge and Market Dynamics

According to media analyst Rajesh Sethi, JioHotstar’s telecom-backed reach of over 481 million users gives it a distinct advantage. He foresees significant growth in subscription video-on-demand (SVoD) revenue, driven by major sporting events like the upcoming Champions Trophy and IPL. The combination of sports content, new releases, and diverse programming across fiction and non-fiction positions the platform strongly for expansion.

However, Sethi warns that content providers may face challenges in negotiations as JioHotstar consolidates streaming rights for major players like HBO and Peacock. “With such a vast user base, JioHotstar enjoys economies of scale. But securing long-term deals for premium content will be a complex process,” he notes.

Additionally, he predicts increased consolidation among smaller OTT platforms. Regional and niche content providers might collaborate to form stronger entities, aiming to secure a competitive foothold against JioHotstar’s dominance. A subscriber base of 15–20 million could give them better leverage in the market.

Mihir Shah, vice president at Media Partners Asia, believes that the JioCinema-Hotstar merger has created a formidable force in India’s premium VOD market. “This isn’t just about content; it’s about using data-driven insights to enhance user experience. The real test now is execution,” Shah says.

For JioHotstar to thrive, he argues, it must focus on interactive engagement, innovative content formats, and delivering a seamless experience across its vast user base.

A Game-Changer or Just Another Player?

While the merger makes JioHotstar a major contender in the OTT space, Anuj Gandhi, founder and CEO of Streambox Media, believes it doesn’t fundamentally disrupt the landscape. “It’s now bigger, but other platforms will continue to coexist and grow,” he says.

He suggests that JioStar’s strategy extends beyond local competitors like Zee and Sony—it aims to challenge global tech giants like Google and Meta, which dominate 70–75% of India’s digital advertising market. “JioHotstar can now offer advertisers a premium audience, something YouTube and Meta lack. While big tech sets the ad pricing benchmarks, JioHotstar’s scale and content quality give it the leverage to command higher rates,” Gandhi explains.

However, Bhasin remains skeptical about any immediate shifts in digital ad spending. “For over a decade, Google and Meta have captured over 75% of India’s digital ad market. That’s unlikely to change overnight,” he says.

The remaining 10–12% of digital ad spending is split among the next tier of players, including LinkedIn and Hotstar, while thousands of smaller platforms divide the final 10–11%. Any market shifts, he suggests, will primarily impact mid-tier and smaller players rather than the established giants.

What It Means for Advertisers

The JioHotstar merger presents fresh opportunities for brands and marketers. Shrenik Gandhi, co-founder and CEO of White Rivers Media, sees the combination of Reliance’s telecom infrastructure, Jio’s vast data resources, and Disney’s premium content as a powerful proposition.

“This integration allows for precision-targeted advertising at an unprecedented scale, putting JioHotstar in direct competition with global streaming giants,” he says.

By leveraging cross-platform insights, advertisers can refine audience targeting and enhance campaign efficiency. The platform’s reach also enables premium audience engagement, making it an attractive choice for brands looking to maximize digital impact.

Siddharth Devnani, co-founder and director of SoCheers, highlights the advantage of a single, consolidated streaming platform. “Eliminating multiple apps and fragmented ad spending makes JioHotstar a one-stop solution for marketers. It’s a massive, unified audience—something every advertiser dreams of,” he says.

With millions of users concentrated on one platform, marketers gain deeper consumer insights, enabling highly

targeted, results-driven campaigns. “The era of scattering budgets across multiple small platforms is ending. Now, brands will focus on making a significant impact in one place,” Devnani concludes.

Conclusion

JioHotstar’s arrival marks a pivotal moment for India’s OTT industry. By merging two of the country’s biggest streaming platforms, JioStar has created a content powerhouse with massive reach and a strong competitive edge. However, challenges remain—from user retention to content acquisition and long-term monetization strategies.

The platform’s success will depend on its ability to strike the right balance between pricing, content quality, and advertising appeal. While the OTT space remains dynamic, JioHotstar’s scale and backing give it a formidable presence in the evolving digital entertainment landscape.